Federal Reserve launches QE3

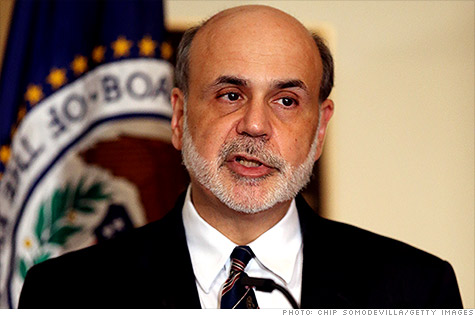

@CNNMoney September 13, 2012: 1:16 PM ET Is the third time the charm? Federal Reserve Chairman Ben

Bernanke certainly hopes so, as the central bank launched QE3 in an

attempt to stimulate the economy.

Is the third time the charm? Federal Reserve Chairman Ben

Bernanke certainly hopes so, as the central bank launched QE3 in an

attempt to stimulate the economy.The policy, known as quantitative easing and often abbreviated as QE3, entails buying $40 billion in mortgage-backed securities each month. The end date remains up in the air, as the Fed will re-evaluate the strength of the economy in coming months.

In addition, the Fed also indicated that it plans to keep interest rates at "exceptionally low levels" until mid-2015. Previously, the Fed had forecast rates would remain low until late 2014.

The central bank's main objective is to lower interest rates and mortgage rates in particular. By keeping rates low, the Fed hopes to fuel more spending and eventually, more hiring.

The policy "should put downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative," the Fed's official statement said.

Meanwhile, the Fed will continue its existing policy known as Operation Twist. Together the two programs will add $85 billion in long-term bonds to the Fed's balance sheet each month.

Related: QE3 won't create jobs

The Fed has been trying to stimulate the economy for over three years now, and has exhausted its usual tool by keeping interest rates near zero since late 2008. Quantitative easing is an unconventional way of trying to lower rates further.

Still, the Fed is not satisfied, given that the unemployment rate has remained above 8%.

In a speech two weeks ago, Fed Chairman Ben Bernanke called the job market a "grave concern." Later, the government's jobs report showed hiring slowed substantially in August and the labor force shrank.

In its statement Thursday, the Fed indicated it will not only continue QE3, but also "employ its other policy tools" if the "labor market does not improve substantially."

The Fed's accommodative policies have been contentious from the start. Republicans often warn that as the Federal Reserve has expanded the money supply, it has set the economy up for rapid inflation in the future.

Meanwhile, economists expect the benefits to be minor, and the risks are uncertain. The first two rounds of quantitative easing lowered interest rates and fueled stock market gains, but banks haven't been eager to lend out money readily.

Martin Feldstein: What worries me about QE

Banks are sitting on $1.6 trillion in reserves and credit standards remain tight following the financial crisis. Households continue to pay down debt, and are in no hurry to ramp up their spending.

That said, it's possible the Fed's move could help the housing market slightly. New construction and home prices have already started picking up recently, and should mortgage rates fall further, that could fuel a quicker housing recovery.

The QE3 move comes after Bernanke has repeatedly urged Congress to do more to support the recovery in the short term, while still addressing the country's debt problem over the long term.

But Congress has done little to heed his advice, and given it's an election year, they're not expected to act anytime soon. Economists often cite the threat of fiscal cliff as one of the key reasons businesses remain reluctant to hire new workers.

The Fed may have acted Thursday, partly to offset the drag from fiscal policy.

In implementing QE3, the central bank does not use taxpayer money to buy bonds. Rather, it expands the U.S. money supply and electronically credits banks with more funds.

Of the Fed's 12 voting members, Richmond Fed President Jeffrey Lacker was the only one to oppose Thursday's decision. He objected against the 2015 forecast and QE3. He has dissented at every Fed meeting since January.

No comments:

Post a Comment