This morning, Mitt Romney and Paul Ryan stood on a platform in

Norfolk, Virginia, and introduced themselves to the country

as "America's Comeback Team."

"Go Back Team" would be more appropriate -- because a

Romney-Ryan administration is the definition of a fast

track back to the failed, top-down economic policies of the

past.

In Ryan, Romney has selected a running mate best known for

designing the extreme GOP budget that would end Medicare as

we know it, and -- just like Romney's plan -- actually

raise taxes on middle-class Americans to pay for an

additional $250,000 tax break for millionaires and

billionaires. As a leader of the House Republicans and a

Tea Party favorite, Congressman Ryan has led the

relentless, intensely ideological battle for these kinds of

budget-busting policies that punish seniors and the middle

class.

Today, Romney doubled down on those policies.

But most Americans don't know Paul Ryan. In the coming

days, the other side will spend a lot of time trying to

define Romney's choice and what it says about his candidacy

-- so we put together a brand-new website on Romney-Ryan

with everything you need to know.

Check it out, watch the video, and then show your support

for President Obama and Vice President Biden by sharing it

with friends and family:

http://my.barackobama.com/Go-Back-Team8If their records are any indication of how they'd govern,

it's not looking good (unless you're a right-wing

conservative in the top 5 percent of income-earners and NOT

a woman or a worker counting on Medicare in your future).

This isn't a matter of opinion:

-- As an architect of the extreme GOP budget, Ryan will be

Romney's biggest advocate for his plan to give more tax

breaks to millionaires, paid for by $2,000 in higher

taxes on middle-class families with kids.

-- The Ryan plan, which Romney said is "an excellent piece

of work, and very much needed," calls for deep cuts in

education -- from college scholarships to Head Start --

critical scientific research, and clean energy investments,

all to help pay for those tax cuts.

-- Ryan authored the original plan to convert Medicare into a

voucher program, costing seniors an additional $6,000 or more

each year.

-- Ryan talks tough on balancing the budget, but his own

plan would fail to do that for a generation. The burden of

balancing any Ryan budget falls squarely on the backs of

seniors and middle-class families -- while no one at the

top is asked to pay even a dollar more.

-- Both Romney and Ryan are severely conservative,

threatening to take us backward on women's issues and civil

rights. Ryan cosponsored a bill that would ban common forms

of birth control, in vitro fertilization, and abortions

even in cases of rape or incest. He voted against the Lilly

Ledbetter Fair Pay Act, voted against the repeal of "Don't

Ask, Don't Tell," and sponsored a constitutional amendment

to ban marriage equality.

On so many issues, Paul Ryan, like Mitt Romney, has taken

extreme positions that are out of touch with the values

most Americans share.

It's our job, especially in these first few days and weeks,

to make sure voters get the facts on his record, and a

clear picture as to what a Romney-Ryan administration would

look like for regular people, when the slogans fade away

and the real policy decisions they'd face as president and

vice president are on the table.

Check out the new video and site on Romney-Ryan:

http://my.barackobama.com/Go-Back-Team8Thanks for everything.

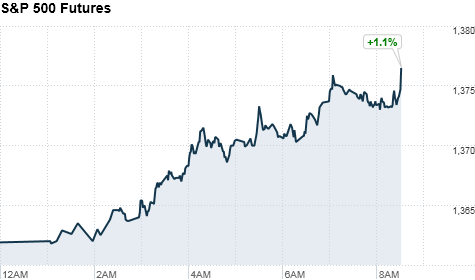

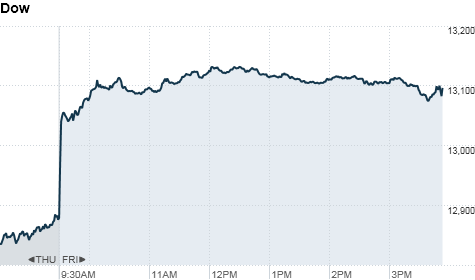

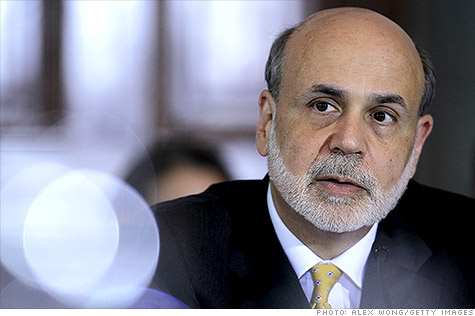

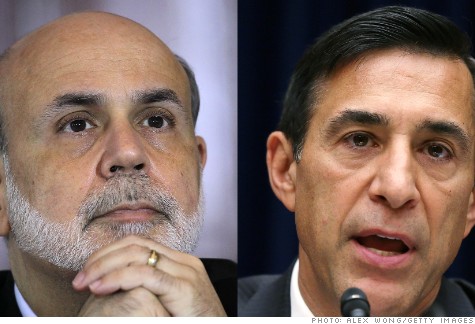

To QE3 or not to QE3? That is the question.

To QE3 or not to QE3? That is the question.

"Rape is rape." The fact that President Obama needed to

"Rape is rape." The fact that President Obama needed to

In 1996, bedeviled by conservative doubts about his tax-cutting

credentials, Bob Dole named Jack Kemp -- the fervent champion of

free-market economics – as his running mate. Sixteen years later,

confronting lingering right-wing skepticism about his conservative

pedigree, Mitt Romney picked Paul Ryan – a former Kemp speechwriter – as

his vice-presidential nominee.

In 1996, bedeviled by conservative doubts about his tax-cutting

credentials, Bob Dole named Jack Kemp -- the fervent champion of

free-market economics – as his running mate. Sixteen years later,

confronting lingering right-wing skepticism about his conservative

pedigree, Mitt Romney picked Paul Ryan – a former Kemp speechwriter – as

his vice-presidential nominee.

Yeah -- THAT Paul Ryan. The architect of the Republican plan to kill Medicare.

Yeah -- THAT Paul Ryan. The architect of the Republican plan to kill Medicare.