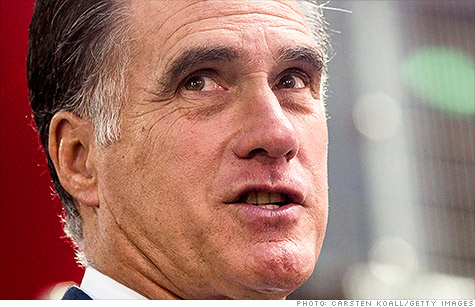

Study: Romney tax plan would shift burden toward poor

@CNNMoney August 1, 2012: 2:01 PM ET A new study indicates that Mitt Romney's tax plan would shift the tax burden to the middle and lower classes.

A new study indicates that Mitt Romney's tax plan would shift the tax burden to the middle and lower classes.The report -- produced by researchers at the Urban-Brookings Tax Policy Center -- illustrates just how difficult it would be to recoup government revenue lost under Romney's plan.

The presumptive Republican presidential nominee's tax plan calls for 20% cuts to today's Bush-era income tax rates. He would also eliminate the Alternative Minimum Tax.

Those tax cuts would lead to a sharp decline in government revenue. Yet Romney insists he will make up the difference in-part by limiting deductions, exemptions and credits currently available to top-level income earners.

Romney refuses to say which tax breaks he plans to eliminate -- but the Tax Policy Center report indicates the plan would force the tax burden to shift toward lower and middle-class Americans.

(Related: Mitt Romney's other tax secret)

"A revenue-neutral individual income tax change that incorporates the features Governor Romney has proposed ... would provide large tax cuts to high-income households, and increase the tax burdens on middle- and/or lower-income taxpayers," the report concludes.

According to the study, the Romney tax cuts would produce a $360 billion revenue loss in 2015, and offsetting that would require a reduction of 65% of all available tax expenditures.

Such popular tax breaks include deductions for mortgage interest and state income taxes, the exclusion from income of employer-paid health insurance and lower tax rates on capital gains.

"Such a reduction by itself would be unprecedented, and would require deep reductions in many popular tax benefits," the report said.

(Related: High price of lower tax rates)

And because most tax breaks go to the poor and middle class, "maintaining revenue neutrality mathematically necessitates a shift in the tax burden of at least $86 billion away from high-income taxpayers and onto lower- and middle-income taxpayers."

The end result is that individuals who make less than $200,000 would actually have to pay $500 more, on average, in taxes -- a 1.2% decrease in after-tax income, the study found.

Meanwhile, the after-tax income of individuals who make more than $1 million would increase by 4.1%.

The Romney campaign disputed the findings of the study, arguing that the analysis was flawed because it did not account for additional revenue that would result from a reduction in the corporate tax rate -- another part of Romney's plan.

"Ignoring the growth effects of corporate tax reform discredits the Tax Policy Center immediately," a Romney campaign spokesperson said.

"By not including the substantial growth effects of the corporate side [of] reforms, the entire study is based on flawed assumptions," the spokesperson added.

No comments:

Post a Comment