Stocks: Choppy trading ahead of Fed

@CNNMoneyInvest August 1, 2012: 1:14 PM ET

NEW

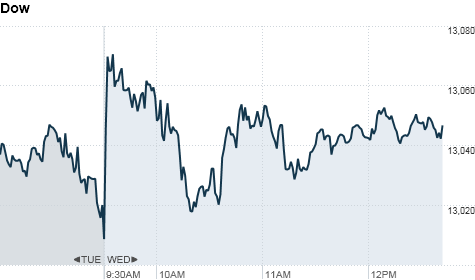

YORK (CNNMoney) -- U.S. stocks made slight gains Wednesday after an

apparent trading error roiled the market ahead of the Federal Reserve's

monetary-policy decision.

The Dow Jones Industrial Average and S&P 500 were up 0.3% in midday trading. The Nasdaq was little changed.

An unusual surge in trading volumes early Wednesday caused several stocks to be halted after circuit breakers were triggered.

The erratic moves appeared to stem from a trading program operated by Knight Capital (KCG).

Knight said in a statement that "a technology issue" occurred in its market-making unit involving about 150 stocks. The firm said it notified clients earlier Wednesday that orders should be rerouted as it reviews the matter internally.

Traders said it appeared a trading program that was supposed to be executed over a period of days was instead executed over the first few minutes of trading Wednesday.

The New York Stock Exchange said it is currently reviewing trades in 148 ticker symbols between 9:30 a.m. ET and 10:15 a.m. ET.

Shares of Knight fell 20% in afternoon trading

The episode was reminiscent of the May 2010 "flash crash," which saw the Dow plunge 1,000 points before rebounding. It also comes after glitches on the Nasdaq marred Facebook's (FB) highly-anticipated IPO earlier this year.

Wednesday's mishap "was a disaster," said Dave Rovelli, managing director of U.S. equity trading at Canaccord Adams. "This is not good for investor confidence. It's like the 'flash crash' all over again."

Meanwhile, the Fed is due to announce the outcome of its latest two-day policy meeting at 2:15 p.m. ET.

Investors are hoping the central bank is moving toward some form of stimulus to jumpstart the slowing economy, but expect that it will hold off from more aggressive actions, such as a third round of bond buying, or QE3.

"They will probably change the language in their statement, and nothing else," said Dan Greenhaus, head equity strategist at BTIG.

The European Central Bank will take center stage Thursday, when its Governing Council meets in Frankfurt. Investors are hopeful that the ECB will announce some form of new action, after central bank head Mario Draghi said last week that the institution will do "whatever it takes" to preserve the euro.

"The Fed is of interest, but the main focus is on the ECB," said Greenhaus, adding that the outcome of Thursday's meeting is "highly uncertain."

Given the high expectations, investors have been reluctant to place big bets ahead of the central bank meetings.

World markets: European stocks closed mixed. Britain's FTSE (UKX) gained 1.4%, France's CAC 40 (CAC40) rose 0.9%, while the DAX (DAX) in Germany edged down 0.3%.

The gains came despite a spate of weak reports on manufacturing activity. The Markit Final Eurozone Manufacturing PMI fell to 44 in July, a more than three-year low but roughly in line with forecasts. Manufacturing activity in the United Kingdom and Italy also slowed in July.

Asian markets ended mixed. The Shanghai Composite rose 0.9% and the Hang Seng in Hong Kong edged higher 0.1%, while Japan's Nikkei lost 0.6%.

There were conflicting signals about manufacturing activity in China in July. HSBC's PMI for the month came in at 49.3, up from 48.2 in June. While the slowdown in activity eased a bit, a reading below 50 still indicates a contraction.

However, figures from the government showed that manufacturing in China expanded slightly during the month, but slowed from June. The China Federation of Logistics and Purchases's PMI came in at 50.1 in July, down from 50.2.

Economy: U.S. private-sector employers added 163,000 jobs in July, according to a report from payroll-processor ADP. Economists had expected an addition of 125,000 jobs.

The Institute for Supply Management said its Manufacturing Index edged higher in July to 49.8 from 49.7 in June. Economists expected the index to come in at 50.1, according to Briefing.com.

The Census Bureau said construction spending rose 0.4% in June, compared with a forecasted 0.5% increase.

Companies: Shares of Apple (AAPL, Fortune 500) have gained 4% this week amid speculation about a possible stock split and potential for its inclusion in the Dow.

Shares of Time Warner (TWX, Fortune 500) shares dipped after the media giant reported reduced second-quarter revenue and earnings Wednesday despite improved results at its television networks unit. (CNNMoney is owned by Time Warner.)

Comcast (CMCSA) reported better-than-expected earnings and sales figures for the second quarter, as the company added new customers for its Internet and phone services.

Shares of Avon Products (AVP, Fortune 500) fell after the company's second-quarter profit dropped 70% from a year ago and sales fell 9%, coming in below expectations.

Pharmaceutical company Allergan (AGN, Fortune 500) said earnings rose 21% in the second quarter from a year ago. It also announced plans to pay a quarterly dividend of 5 cents per share.

Harley Davidson (HOG, Fortune 500) shares sank after the motorcycle maker reported sales growth that disappointed investors, even as profits rose.

Currencies and commodities: The dollar fell against the euro and Japanese yen, but gained ground versus the British pound.

Oil for September delivery rose 12 cents to $88.18 a barrel.

Gold futures for August delivery rose $1.40 to $1,611.90 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 1.49% from 1.43% late Thursday.

The Dow Jones Industrial Average and S&P 500 were up 0.3% in midday trading. The Nasdaq was little changed.

An unusual surge in trading volumes early Wednesday caused several stocks to be halted after circuit breakers were triggered.

The erratic moves appeared to stem from a trading program operated by Knight Capital (KCG).

Knight said in a statement that "a technology issue" occurred in its market-making unit involving about 150 stocks. The firm said it notified clients earlier Wednesday that orders should be rerouted as it reviews the matter internally.

Traders said it appeared a trading program that was supposed to be executed over a period of days was instead executed over the first few minutes of trading Wednesday.

The New York Stock Exchange said it is currently reviewing trades in 148 ticker symbols between 9:30 a.m. ET and 10:15 a.m. ET.

Shares of Knight fell 20% in afternoon trading

The episode was reminiscent of the May 2010 "flash crash," which saw the Dow plunge 1,000 points before rebounding. It also comes after glitches on the Nasdaq marred Facebook's (FB) highly-anticipated IPO earlier this year.

Wednesday's mishap "was a disaster," said Dave Rovelli, managing director of U.S. equity trading at Canaccord Adams. "This is not good for investor confidence. It's like the 'flash crash' all over again."

Meanwhile, the Fed is due to announce the outcome of its latest two-day policy meeting at 2:15 p.m. ET.

Investors are hoping the central bank is moving toward some form of stimulus to jumpstart the slowing economy, but expect that it will hold off from more aggressive actions, such as a third round of bond buying, or QE3.

"They will probably change the language in their statement, and nothing else," said Dan Greenhaus, head equity strategist at BTIG.

The European Central Bank will take center stage Thursday, when its Governing Council meets in Frankfurt. Investors are hopeful that the ECB will announce some form of new action, after central bank head Mario Draghi said last week that the institution will do "whatever it takes" to preserve the euro.

"The Fed is of interest, but the main focus is on the ECB," said Greenhaus, adding that the outcome of Thursday's meeting is "highly uncertain."

Given the high expectations, investors have been reluctant to place big bets ahead of the central bank meetings.

World markets: European stocks closed mixed. Britain's FTSE (UKX) gained 1.4%, France's CAC 40 (CAC40) rose 0.9%, while the DAX (DAX) in Germany edged down 0.3%.

The gains came despite a spate of weak reports on manufacturing activity. The Markit Final Eurozone Manufacturing PMI fell to 44 in July, a more than three-year low but roughly in line with forecasts. Manufacturing activity in the United Kingdom and Italy also slowed in July.

Asian markets ended mixed. The Shanghai Composite rose 0.9% and the Hang Seng in Hong Kong edged higher 0.1%, while Japan's Nikkei lost 0.6%.

There were conflicting signals about manufacturing activity in China in July. HSBC's PMI for the month came in at 49.3, up from 48.2 in June. While the slowdown in activity eased a bit, a reading below 50 still indicates a contraction.

However, figures from the government showed that manufacturing in China expanded slightly during the month, but slowed from June. The China Federation of Logistics and Purchases's PMI came in at 50.1 in July, down from 50.2.

Economy: U.S. private-sector employers added 163,000 jobs in July, according to a report from payroll-processor ADP. Economists had expected an addition of 125,000 jobs.

The Institute for Supply Management said its Manufacturing Index edged higher in July to 49.8 from 49.7 in June. Economists expected the index to come in at 50.1, according to Briefing.com.

The Census Bureau said construction spending rose 0.4% in June, compared with a forecasted 0.5% increase.

Companies: Shares of Apple (AAPL, Fortune 500) have gained 4% this week amid speculation about a possible stock split and potential for its inclusion in the Dow.

Shares of Time Warner (TWX, Fortune 500) shares dipped after the media giant reported reduced second-quarter revenue and earnings Wednesday despite improved results at its television networks unit. (CNNMoney is owned by Time Warner.)

Comcast (CMCSA) reported better-than-expected earnings and sales figures for the second quarter, as the company added new customers for its Internet and phone services.

Shares of Avon Products (AVP, Fortune 500) fell after the company's second-quarter profit dropped 70% from a year ago and sales fell 9%, coming in below expectations.

Pharmaceutical company Allergan (AGN, Fortune 500) said earnings rose 21% in the second quarter from a year ago. It also announced plans to pay a quarterly dividend of 5 cents per share.

Harley Davidson (HOG, Fortune 500) shares sank after the motorcycle maker reported sales growth that disappointed investors, even as profits rose.

Currencies and commodities: The dollar fell against the euro and Japanese yen, but gained ground versus the British pound.

Oil for September delivery rose 12 cents to $88.18 a barrel.

Gold futures for August delivery rose $1.40 to $1,611.90 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 1.49% from 1.43% late Thursday.

No comments:

Post a Comment